While Amazon specifies its AWS revenue, Microsoft only reports on Azure’s growth rate. As of November 2020, AWS added an incremental $10 billion in revenue in the 12 months prior-its faster ever. Andy Jassy, the AWS CEO, kicked off the recent Amazon Web Services re:Invent Conference by announcing that the company had now surpassed $40 billion in annual revenue. Of course, this is not a doom and gloom scenario. The Q1, Q2, and Q3 earnings release statements for 2020 showed the YoY growth rate dropping below 30%-a marked decline over the previous 3 years when growth was consistently between 40-50%. Their 2019 Q4 Earnings Release reported AWS sales revenues of almost $10 billion.Īs 2020 unfolded and the severity of the pandemic took hold, we began to see a significant impact on the growth rate of AWS. Both providers have evolved to offer hundreds of cloud products and services, allowing them to compete across the vastness of the cloud market-their continued innovation adding new cloud solutions that create new and lucrative revenue streams.ĪWS reached an annual revenue run rate of over $40 billion at the end of 2019. Regardless of whether you’re seeking IaaS, PaaS, or SaaS, you’ll discover a competitive cloud solution from Amazon Web Services and Microsoft Azure. Against this backdrop, you can expect AWS and Azure to continue their growth. It’s similarly forcing countless organizations to begin or accelerate their digital transformation journeys to survive. The pandemic has necessitated the need to work remotely, creating an explosion in remote working and leading to an astonishing 94% increase in the Desktop as a Service (DaaS) market.

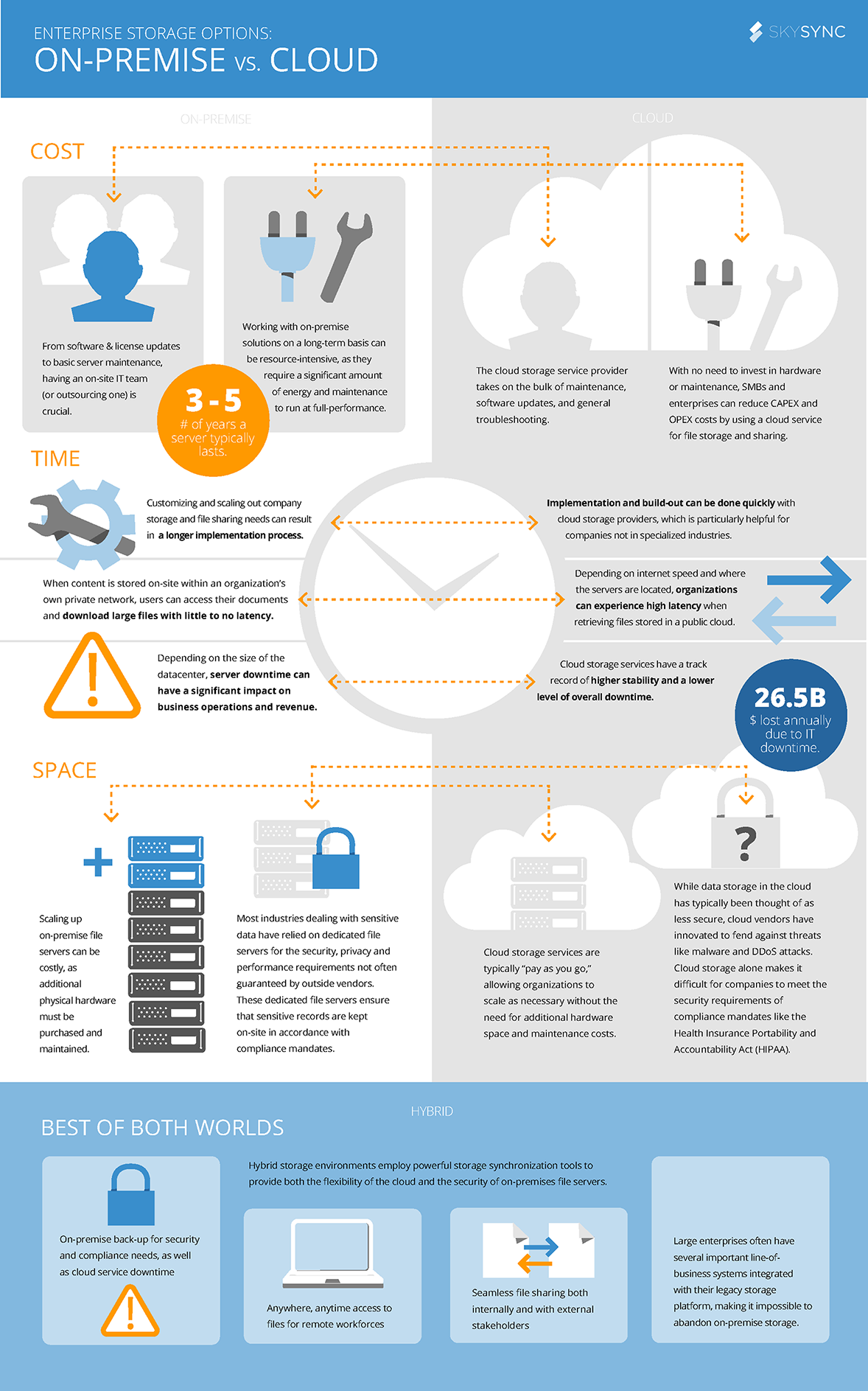

Worldwide Cloud Infrastructure Services Spend, Q3 2020 (Source: Canalys)ĭespite the Coronavirus pandemic causing a global economic decline, the cloud computing market is defying the odds, with Gartner’s most recent forecast predicting growth of 6.3% in Worldwide public cloud revenue in 2020.

This is a trend that seems only set to continue, with both providers seeking to further strengthen their foothold in the market through investment and innovation in their cloud platforms. 2020 Magic Quadrant for Cloud Infrastructure as a Service, Worldwide (Image source: Gartner) AWS and Microsoft Azure Dominate Cloud Market ShareĪccording to the latest research from Canalys and Synergy Research Group, Microsoft Azure and AWS combined control more than 50% of worldwide cloud infrastructure services spend. AWS takes the honor of a first place, securing the top spot for the tenth consecutive year. Both feature highest in the top-right corner of the Leaders quadrant, awarded on Ability to Execute and Completeness of Vision. Unsurprisingly, Microsoft and Amazon Web Services have again been named Leaders in Gartner’s most recent Magic Quadrant for Cloud Infrastructure and Platform Services. Both providers have led the creation of new cloud products and services since the technology’s emergence. Each was uniquely renowned for a history of innovation, excellence, and market dominance.Įmbarking into the cloud frontier, they had the ideal technological foundation, expertise, and financial resource to develop industry-leading cloud computing platforms. If you’re exploring cloud products and services, then Google Cloud Platform, Microsoft Azure, and Amazon Web Services are the three providers who’ve become synonymous with “cloud,” with Alibaba Cloud joining the fold recently.īefore rising to prominence in the cloud market, Amazon and Microsoft were global leaders in their respective fields.

Every industry has its market leaders-a select few companies that rise above the rest, setting the benchmark for excellence.

0 kommentar(er)

0 kommentar(er)